A fixed asset (which max be referred to as a ‘non-current asset’ for a company) may have a useful life of several years, after which time it may be of little or no value. Depreciation is a mechanism used in the accounts to deal with this decline in value and to spread the cost of the asset over its useful life.

If depreciation were not used, the accounts would not give a true reflection of the position of the business. The assets would be stated at their cost value,

which may, over time, be well above their actual value.

Depreciation has to be carried out in a systematic way, but the method used should mirror as closely as possible how the asset loses value in the course of the relevant accounting periods. The method that is ultimately chosen will depend not only on how the asset loses value but how it produces revenue for the business on an ongoing basis. As you will see below, an asset such as shelving will use the straight-line method because the asset is being used up consistently over its lifespan and is generating a consistent amount of income. But an asset such as a van, however, will produce much more revenue for the business in its earlier years of use and hence the reducing balance method will be more relevant. This amount is known as the ‘charge to depreciation’ or ‘depreciation charge’.

Depreciation methods

There are two common ways used to depreciate assets, the Straight-line method and the Reducing balance method.

Straight-line method

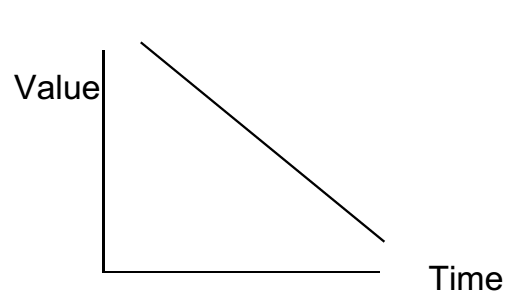

The straight-line method of depreciation spreads the depreciation charge evenly over the life of the asset and gives rise to the same charge for depreciation each year.

This is the most common and straightforward method of depreciation and is used where the service provided by the asset continues throughout its useful economic life on a consistent basis. If plotted on a graph, the depreciation of the asset would form a straight line.

Example

Q&B DIY Store buys some shelving for its warehouse, costing £10,000. The shelving is expected to last for 5 years. The cost will be spread evenly over the five year period. A depreciation charge of £2,000 (i.e. £10,000 ÷ 5) will be made each year. This annual depreciation charge will ‘accumulate’ over the years. In year one, the accumulated charge will be £2,000, year two £4,000, year three £6,000 etc.

The charge each year (i.e. £1,200 in the example above) will be included in a depreciation account as the loss in value of the shelving constitutes a ‘cost’ to the business and will be shown on the Profit and Loss Account as an expense.

The accumulated depreciation will be included in an accumulated depreciation account (liability account) thereby reducing the net book value of the asset and will be shown on the Balance Sheet. In the example given above, the accumulated depreciation after Year 3 will be £6,000.

Reducing balance method

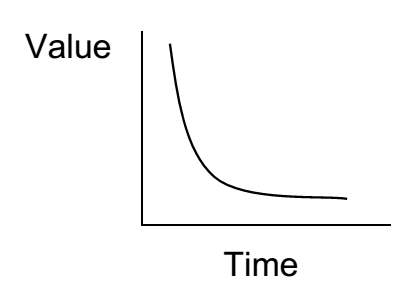

The depreciation charge each year is expressed as a percentage (x %) of the reducing balance (i.e. the net book value of the asset at the start of the relevant accounting period). This means that more depreciation is charged in earlier years than in later years since the net book value of the asset reduces year on year.

This method is less common and slightly more complicated than the straight-line method. The reducing balance method would be used where an asset is likely to lose a large part of its value in the first few years of ownership e.g. motor vehicles. If plotted on a graph the depreciation of the asset would form a curved line.

Example

Sparks Electricians buys a van for £15,000 for use in the business. The van will be depreciated at a rate of 20% of the reducing balance each year.At the end of Year 1, a depreciation charge of £3,000 (i.e. 20% of £15,000) will be made. This will be shown as an expense on the Profit and Loss Account for that year. It will also appear as a liability on the Balance Sheet, set off against the purchase (or cost) value of the van.

At the end of Year 2, the depreciation charge will be calculated as follows: the accumulated depreciation for the previous year (£3,000) is

deducted from the cost of the asset in the trial balance. In this case the calculation will be £15,000 – £3,000 = £12,000. This figure of £12,000 is the reduced balance. The depreciation charge for Year 2 is calculated by applying the depreciation rate (20%) to the reduced balance (£12,000). This gives a depreciation charge for Year 2 of £2,400. This will be shown as an expense on the Profit and Loss Account for the second year. The accumulated charge at the end of Year 2 is £5,400 (£3,000 + £2,400) and this appears on the Balance Sheet as a liability.At the end of Year 3, a depreciation charge of £1,920 (i.e. 20% of (£15,000 – £5,400) will be made. This will be shown as an expense on the Profit and Loss Account for Year 3. The Balance Sheet as at the end of Year 3 will show accumulated depreciation of £7,320.

Dual effect of depreciation

As we have seen above, depreciation is recorded in an expense account and a liability account.

- Expense: An expense account is used because depreciation is an expense of the business each year, indicating that its assets are falling in value. The depreciation charge for each year will be shown in a depreciation account on the Profit and Loss Account.

- Liability: The liability account accumulates all the annual expenses (as seen above). It has the effect of reducing the particular asset account. The accumulated depreciation will be shown in an accumulated depreciation account on the Balance Sheet.

Net Book Value

Fixed (or non-current) assets are recorded at the top of the Balance Sheet. The original cost of the asset is shown, as is the accumulated depreciation relating to that asset. A calculation is then performed to show the current value of the asset after taking into account its loss of value due to depreciation.

COST – ACCUMULATED DEPRECIATION = NET BOOK VALUE

The Net Book Value of an asset is an estimate of the current value of the asset to the business.

Depreciation year-end adjustment

When you are given a preliminary trial balance, there will be no depreciation charge for the current year in the trial balance; and the figure in the Provision for Depreciation account shown in the trial balance is the accumulated depreciation from previous years before charging depreciation for the current year.

To make the year-end adjustment for depreciation, you have to:

- calculate the depreciation charge for the year and include it in the list of expenses; and

- add the depreciation charge for the year to the accumulated provision for depreciation account.

Pingback: Year-end adjustments – The Law Student Blog